Weekly Plan for December 1

S&P 500 moved 1% higher the previous week. The previous week was shortened by the Thanksgiving holiday. I will go into my weekly plan below.

Summary

The S&P moved out of a small consolidation to the upside. Typically Thanksgiving holidays are bullish more than 75 percent of the time. I expect more two-sided action and higher volume this coming week as major players return.

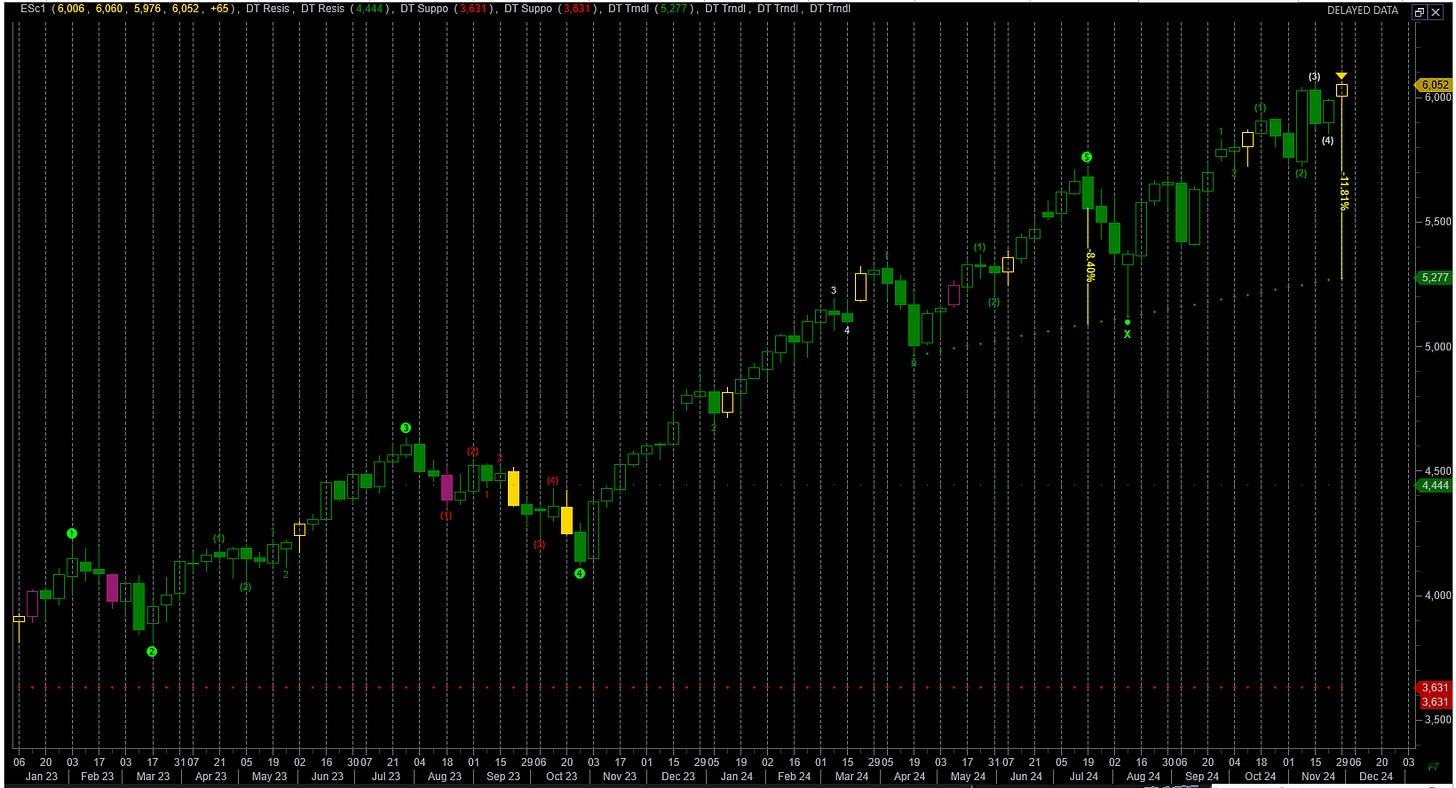

S&P 500 Futures Daily

The chart below represents the S&P futures volume profile chart. There are a number of nuances in the chart below. The highlighted rectange to the left shows a four day balance. On Friday price broke out to a new high.

The price action was similar to the previous week which showed a four day balance followed by break out to the upside.

The Weekly S&P futures chart.

This chart shows the trendline drawn from 4/19/2024 low. At the high in July ( 7/16/2024) price was extended approximately 10 % above this trendline. Currently price is 12% extended above this trendline. Potentially, price could revert to the mean (the trendline).

Note that just because the price action is extended does not mean that price will revert to the mean. It just implies new long trades are riskier and poorer risk to reward. Obviously going short is risky since the trend is bullish.

The best thing to do is wait for price discovery to take place and see if a new price base gets built.

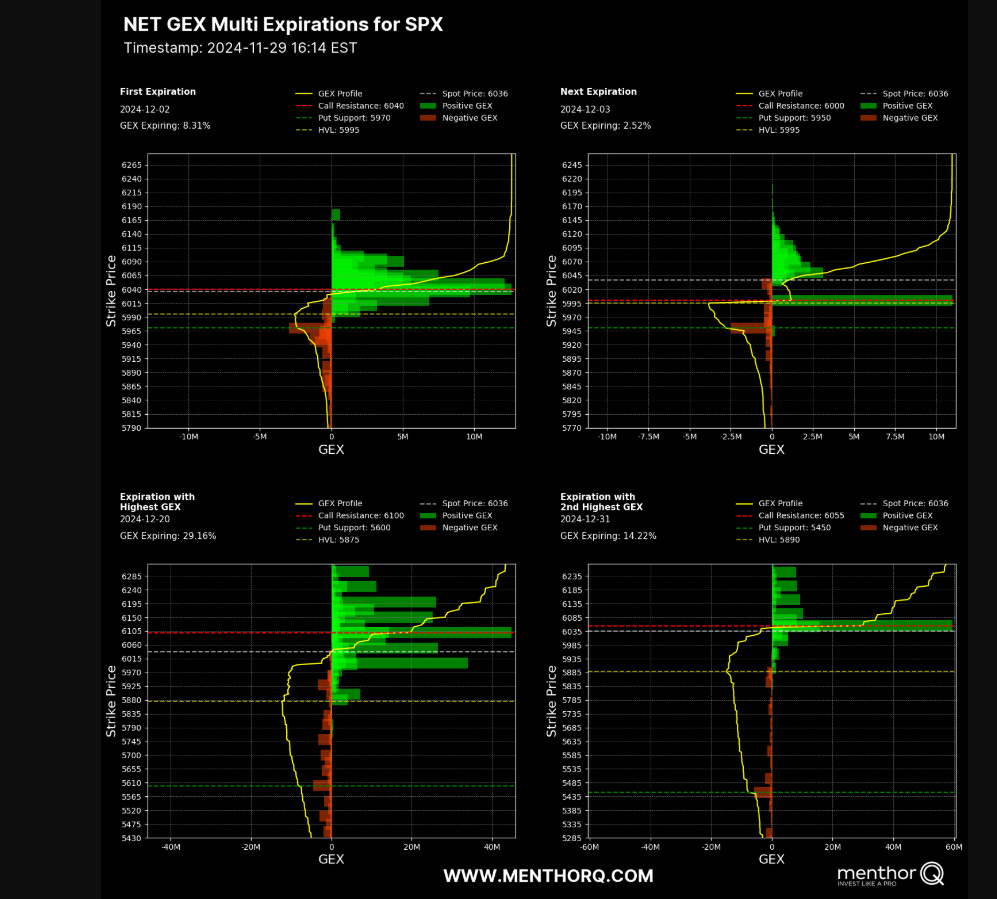

S&P 500 Cash Gamma levels

For the current week market participants are mostly bullish. If price breaks below 5980 - 5970 zone then S&P 500 cash index goes from a bullish to bearish positioning. The S&P cash index closed at 6032.

Looking towards the end of the year, I observe that large players are positioned for price to move higher.

I do expect some price discovery to the downside this week, however I expect that to get bought and therefore we could see S&P 500 closer to 6100 by year end.

The market maker implied move for the S&P futures this week is +/- 58 points.

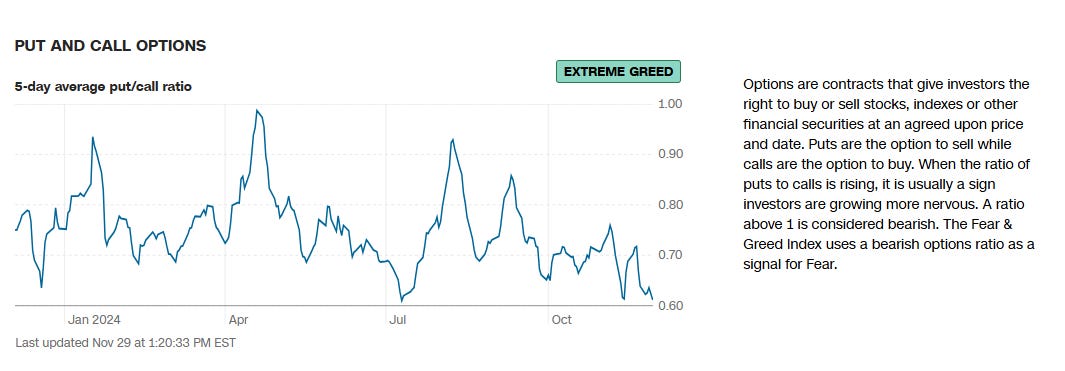

Market sentiment as depicted by the week’s 5 day average put/call ratio is showing extreme greed.

US Market Moving Events

The market moving events for the week of 12/01/2024

Monday, December 2, 2024:

ISM Manufacturing Index (10:00 AM ET): This report provides insights into the health of the manufacturing sector.

Construction Spending (10:00 AM ET)

Federal Reserve Bank of New York

.

Tuesday, December 3, 2024:

Job Openings and Labor Turnover Survey (JOLTS, 10:00 AM ET): Provides data on job openings and labor demand, which can influence market sentiment

Federal Reserve Bank of New York

.

Wednesday, December 4, 2024:

Gross Domestic Product by County and Metropolitan Area (8:30 AM ET): A regional breakdown of economic activity, offering insights into localized growth trends

.

Thursday, December 5, 2024:

U.S. International Trade in Goods and Services (8:30 AM ET): A key indicator of trade balance, influencing economic outlook and currency markets

.

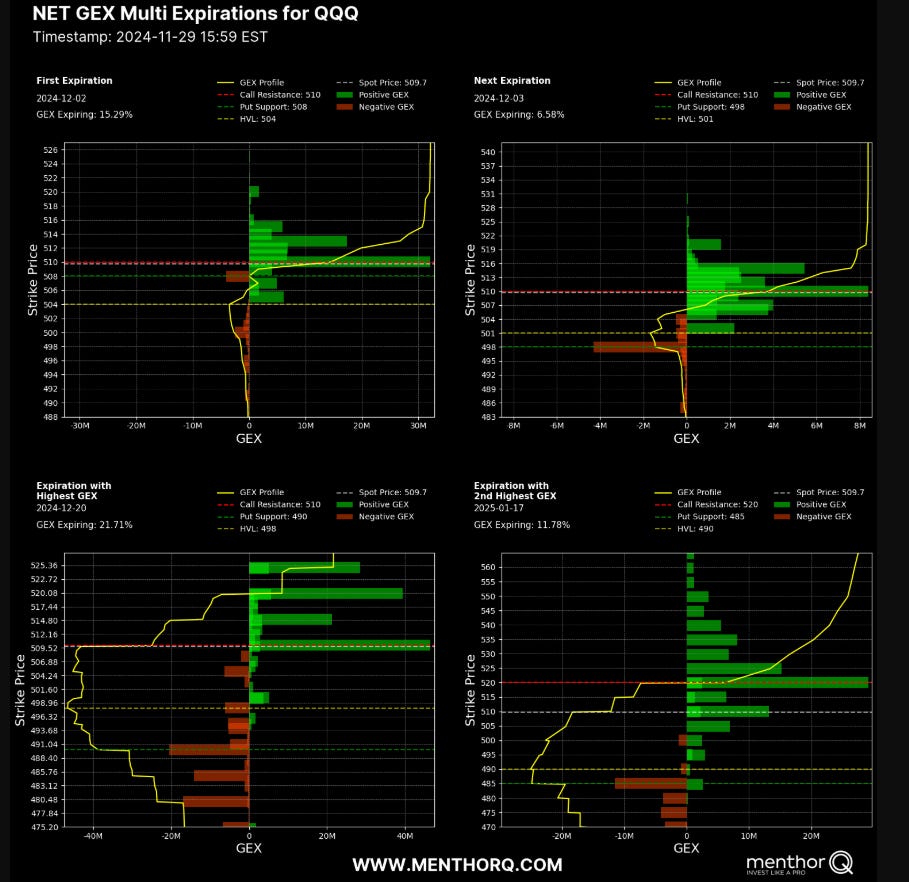

Looking at the QQQs or the Nazdaq 100 futures are an important part of my trading plan. The XLK (technology ETF) represents a 30% component of the S&P500. Therefore I use this as an indicator to trade the S&P.

QQQ Weekly Chart

The QQQs are the ETF representation of the Nazdaq 100. Price has been in a consolidation pattern over the last three weeks.

QQQ Gamma levels

The chart below shows the positioning information for QQQ. Price falling below 501 would signal bullish to bearish positioning. The QQQs closed at 509.75.

The QQQs are also positioned bullish throughout the end of the year.

The Weekly Plan

Currently I am in a few different bullish trades for S&P 500. If the S&P 500 falls below 5980 - 5970 area then those trades will get closed.

For example, I have a short bull put spread expiring this week for 5910/5900.

I am currently nuetral for the week. I am waiting for price discovery to take place to determine my next move.

Sample Weekly Idea for S&P futures

Scenario 1

If price falls 6033 then we could target 6000, 5990, 5970

Scenario 2

If price moves above 6033 then we could target 6070 to 6100.

To compute the S&P 500 cash values, just subtract 20 from the S&P 500 futures to get the equivalent prices.

Have a successful trading week, by waiting for your trade setups to come to you.

Thank you for reading my weekly plan.

Gamma Level data (netgex data) was provided by menthorQ.com

Disclaimer

Trading involves Risk. Please don’t follow my idea(s) blindly. Do your own due dilligence before you attempt to trade.

Always manage your risk.

Joel