Weekly Plan for January 12

On Friday January 10 the S&P 500 cash index broke out of balance lower. Will price continue down for the week? I describe my weekly plan below.

Summary

January is generally a seasonally bullish period for the market. Major players returned from vacation and sold the S&P 500 during the first full week of 2025. The decline was approximately 2.3 percent. I expect continued volatility for this week since both CPI (Consumer Price Index) report and PPI (Producer Price Index) report will get released during the upcoming week.

Management of last week’s plan

For the week I was positioned in a neutral to bearish trade for S&P 500. The market was below its short term moving averages (5, 8, 20 simple moving averages). Positioning was bearish. I closed out the trade for a profit by end of the week.

S&P 500 Futures Daily

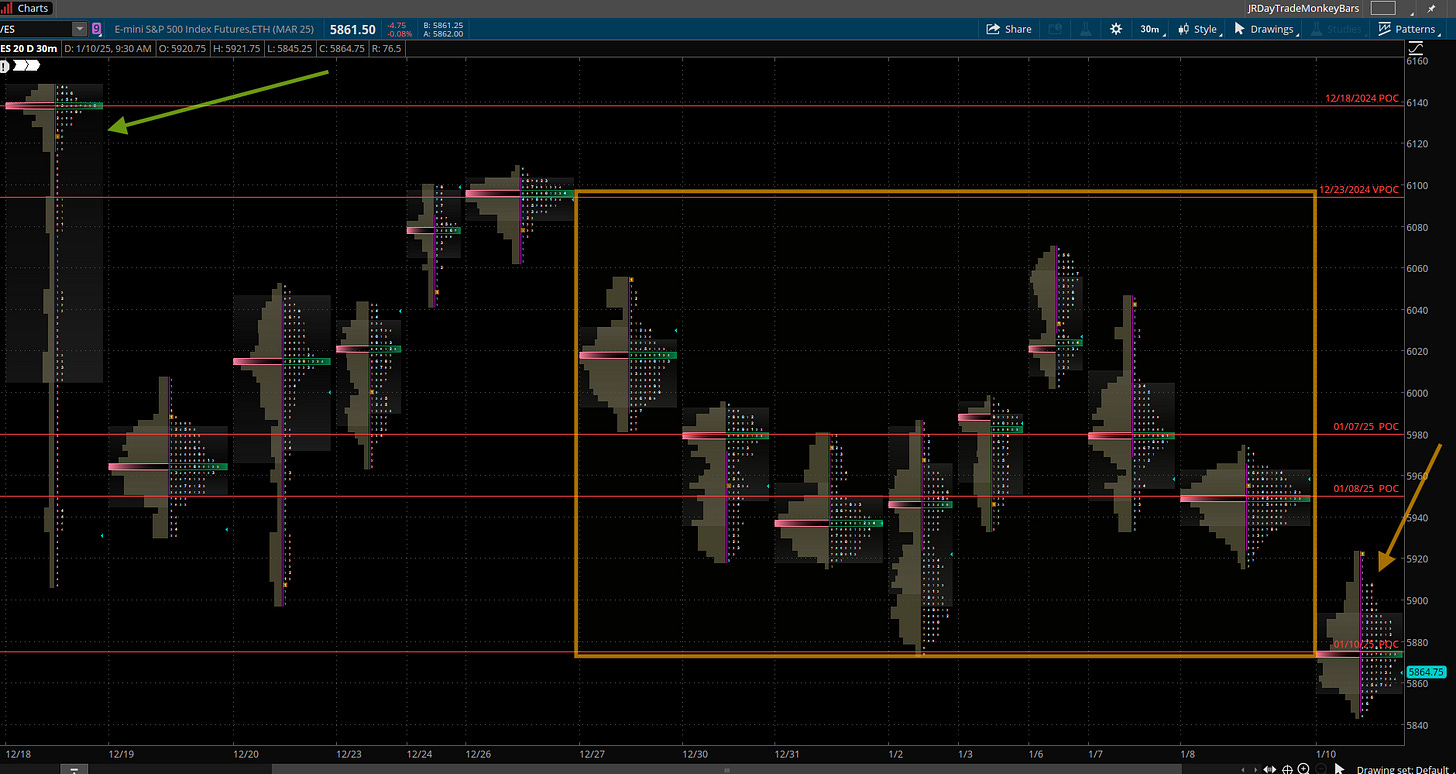

The chart below is the market/volume profile of the S&P futures. The large rectangle includes the last eight days of price action. The green arrow points to the price action on the FOMC day. This day was a highly emotional. The federal reserve made short term rate cut, however the Fed’s discussion post rate cut was viewed as hawkish.

During the past few weeks, the S&P 500 has remained in a large balance area. I have placed a rectangle around the last 8 days showing the range (6074 - 5870). The yellow arrow to the right points to Friday’s action. This was a reaction to the unemployment report. Clearly, price action broke below the balance area with the majority of the price action lower. It is noteworthy to observe that the point of control is resting at the lower end of the balance area. A much more bearish market would have had decisively lower point of control.

The Daily S&P futures chart.

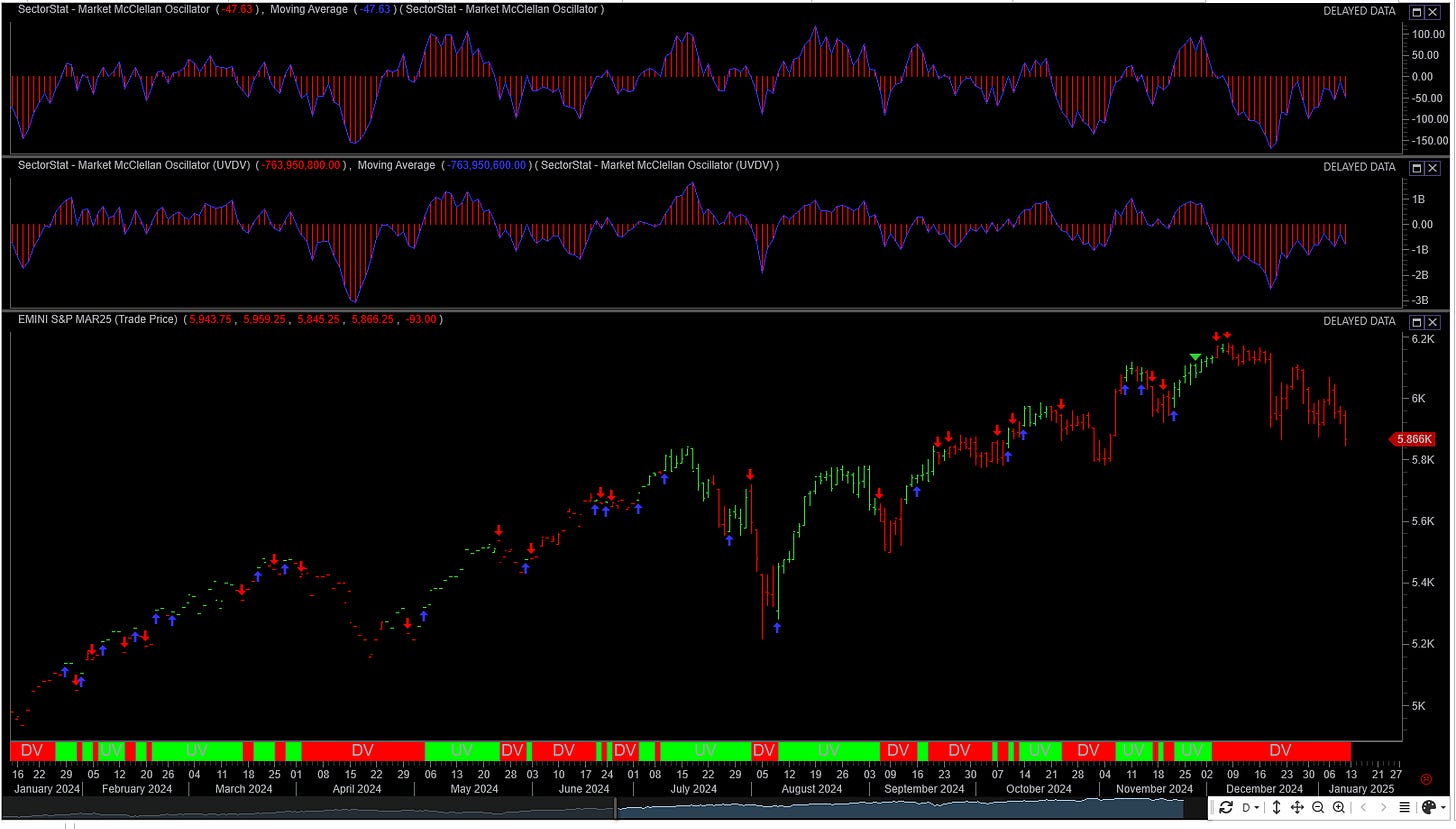

Both market and volume sentiment continues to stay bearish over the last week of trading. This is depicted by the chart below. This chart shows the McClellan Oscillator. The two histograms in chart represent market and volume sentiment. The S&P 500 price is shown in lower section of the chart.

This viewpoint has not changed in the last week and remains bearish from both a market and volume sentiment.

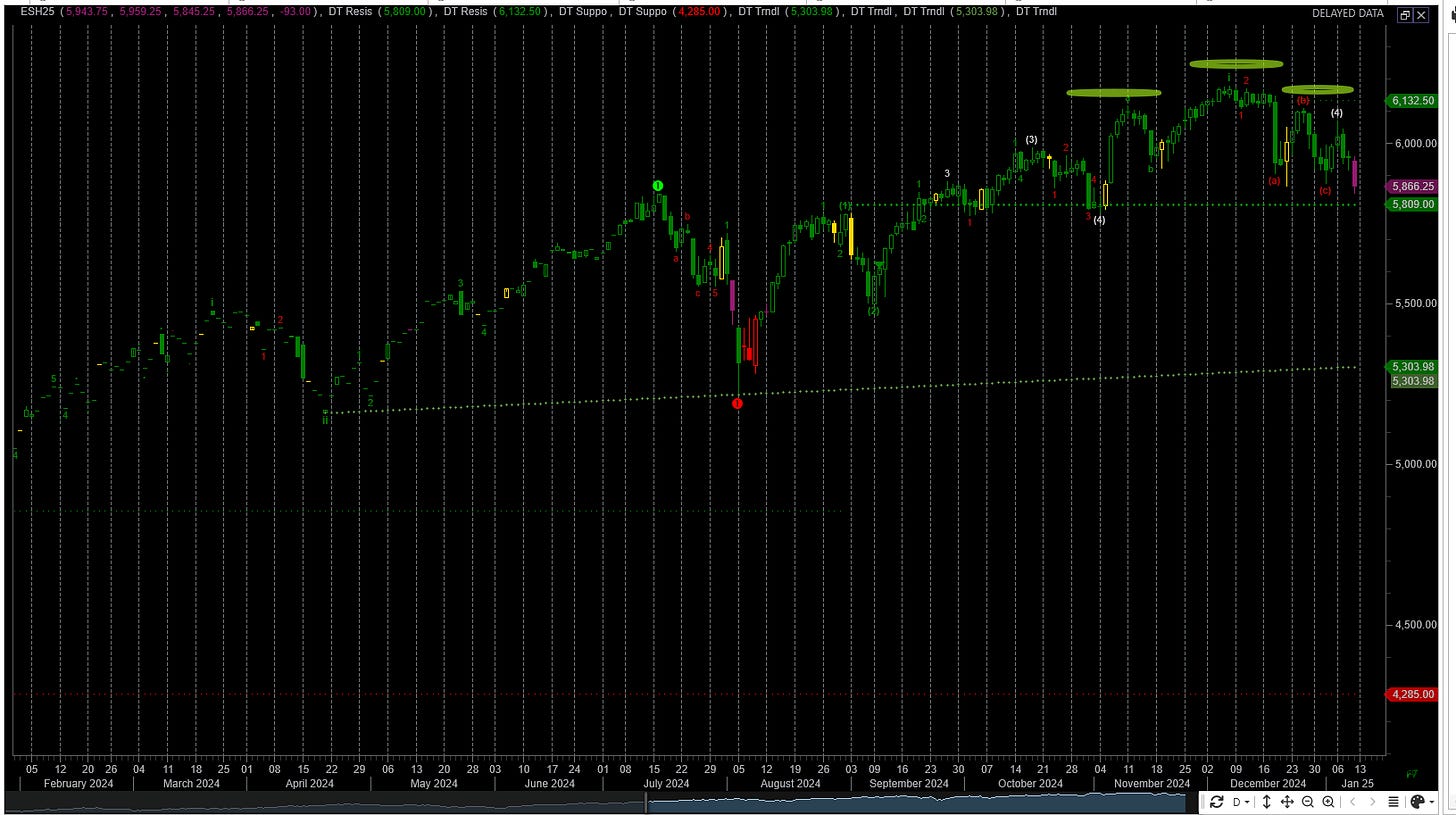

This chart below shows the daily price action of the S&P futures. I have circled areas of interest. It is noteworthy that price bounced higher after hitting this area twice before. During the timeframe 10/1 - 10/4 of 2024 as well 10/31 - 11/5 price touched this area and was bought. On 7/16 and 8/30 this area acted as resistance zone.

Will the S&P get bought again at this level? The area is approximately 40 points below Friday’s close. This is a key area on the downside.

Another interesting pattern is showing a head and shoulders’s pattern. This is a bearish pattern with a strong potential for greater downside price action.

The S&P 500 skew has moved lower from a high of 181 to 151. A lower value for shew suggests decreased demand for tail-risk hedges. This value is still relatively high indicating the market participants are still hedged to the downside.

This chart shows monthly skew values over the past 2 years. The skew continues to decline as out of the money hedges are monetized.

Long Term rates rise

After the FOMC cut rates there has been a steady increase in long term rates. This appears counter intuitative. The bond market is forward-looking, and higher long-term yields can reflect worries about inflation remaining persistent, high government debt levels, or a shift toward stronger economic growth despite lower short-term interest rates.

The chart below shows the yield on the 10 year treasury. Yields are near the 5 percent level.

A rise in long-term rates increases the discount rate used to value future earnings of companies. The higher the discount rate, the lower the present value of future cash flows, which generally depresses stock prices.

This is particularly impactful for growth stocks, where a significant portion of their value is derived from future earnings. Technology stocks ( the nazdaq 100 or 30 percent of the S&P 500), for example, may be more sensitive to rising rates.

Rising long-term rates may make bonds more attractive relative to equities, as the yield on government debt increases. As bond yields rise, investors may shift funds from the equity market (S&P 500) into bonds, causing selling pressure on stocks.

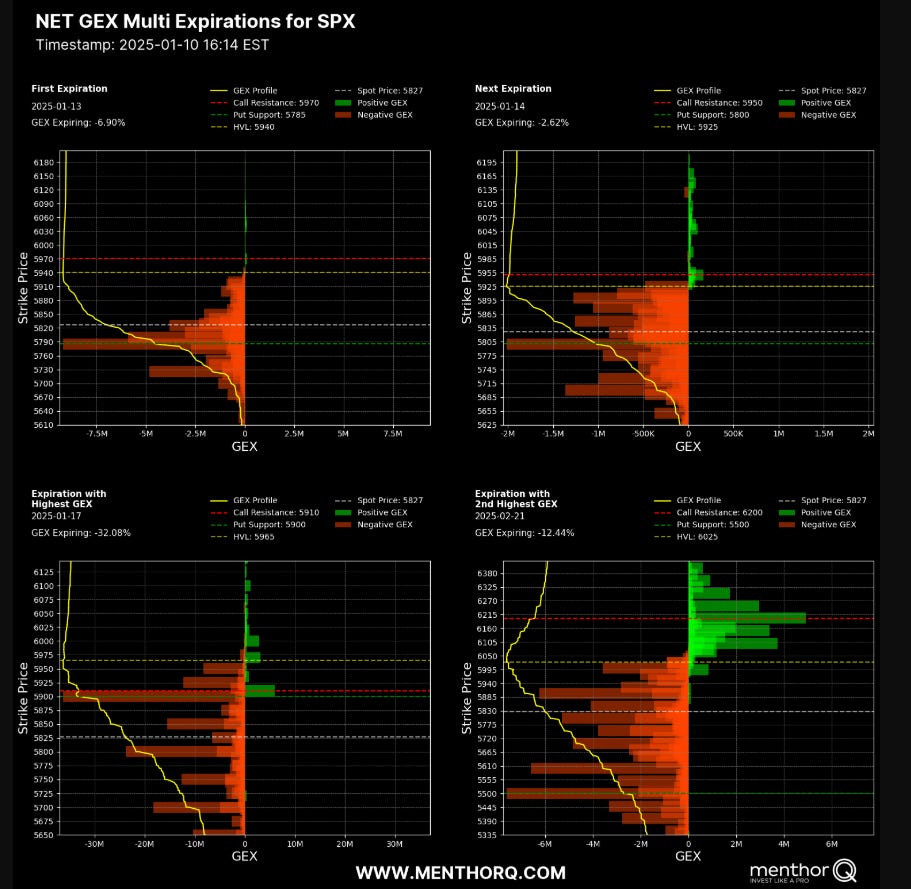

S&P 500 Cash Gamma levels

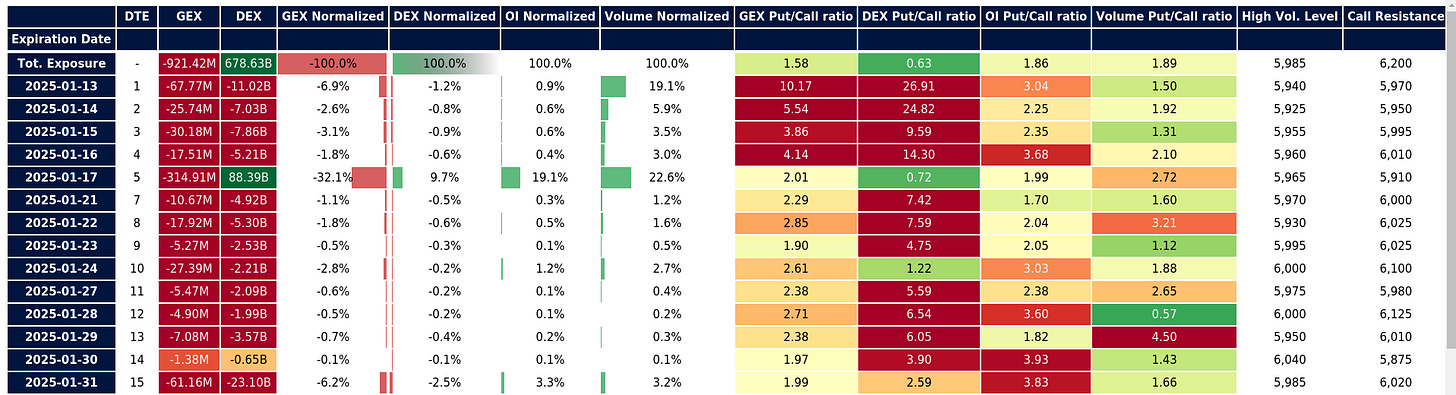

For the next 15 days market participants are positioned mostly bearish. If price breaks below the 5820 - 5800 zone then S&P 500 cash index could fall to an area between 5750 = 5725.

Above 5950 - 5970 zone, positioning is supportive of a bullish narrative. A potential target is 6050. The 6050 zone is the 20 day simple moving average.

Market makers are positioned to trade in the direction of the market. This is due to the negative gamma effect. This implies that moves both up and down will be large and extreme. This is period of time to trade smaller size and less frequently.

Market positioning is pictured below

The market maker implied move for the S&P futures this week is +/- 119 points. Therefore the market maker expected range is between 5700 to 6940.

US Market Moving Events

In the week of January 13, 2024, several key events are expected to influence the financial markets:

Economic Data Releases:

Consumer Price Index (CPI): Scheduled for release on Wednesday, January 15, the CPI is anticipated to show a year-over-year increase of 2.9%, providing insights into inflation trends.

Producer Price Index (PPI): Set for Tuesday, January 14, the PPI is expected to rise by 3.5%, offering a perspective on wholesale inflation.

Retail Sales Data: The Census Bureau will release December's retail sales figures, shedding light on consumer spending during the holiday season.

Housing Starts: Data on new residential construction will be available, providing insights into the housing market's health.

Federal Reserve's Beige Book: This report will offer a snapshot of economic conditions across various regions, aiding in understanding the broader economic landscape.

Corporate Earnings:

Wednesday, January 15:

JPMorgan Chase

Goldman Sachs

Wells Fargo

Citigroup

BlackRock

Thursday, January 16:

Bank of America

Morgan Stanley

Taiwan Semiconductor Manufacturing Company (TSMC)

UnitedHealth Group

QQQ Weekly Chart

Looking at the QQQs or the Nazdaq 100 futures are an important part of my trading plan. The XLK (technology ETF) represents a 33% component of the S&P500. Therefore I use this as an indicator to trade the S&P 500.

The QQQs broke a long term trend line and I have bearish current view.

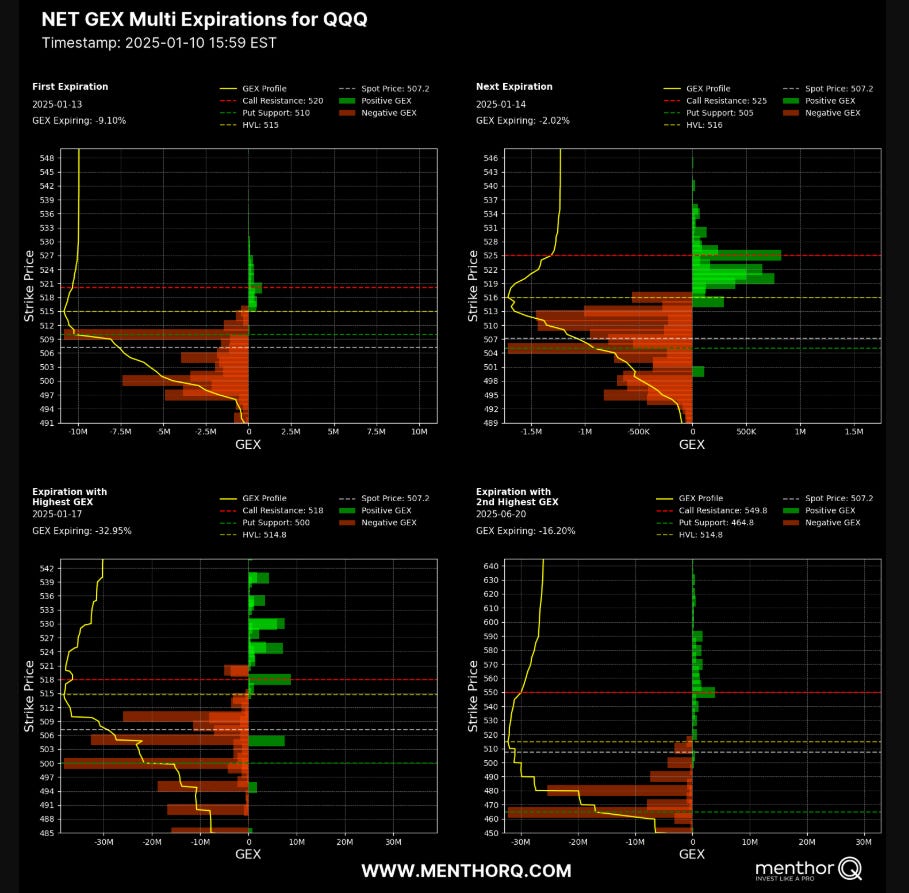

QQQ Gamma levels

The chart below shows the positioning information for QQQ. Price staying below 515 is viewed as bearish positioning. Above the 525 level is constructive to the bullish narrative.

The Weekly Plan and trading idea

Going into this week, I have a neutral to bearish trades on the SPX ( the S&P 500 cash index).

The S&P has moved lower over the last few weeks. Each bounce higher has been met with selling.

Current trade

For January 24 expiry I am net short calls with the following trade:

1 Long 6015 call, 2 Short 6035 call, 1 Long 6100 call.

The trade is defined as a broken wing butterfly. I am viewing this as a credit collection trade, however the trade does have the potential to make 20 points on expiration. A standard butterfly is symetrical in that the long options are equdistant from the short option. In my trade, I have the higher purchased option a greater distance from the short strike in order to place this trade as a credit.

The trade was placed Friday near the high of the day.

This trade was put on for $3 credit per contract. It currently has probability of 80 percent to expire worthless. The short strike was placed above the 20 simple moving average.

If I let the trades run till January 24, I will collect the full credit. I plan on closing these trades when values falls 75 percent of the credit collected.

trade management

The trade is managed with two orders placed simultaneously using a structure “One cancels the other orders”. One order is the take profit while the other is the stop loss order. Both orders are actively management to increase profit potential along with mitigating risk.

S&P futures Weekly Scenarios

Scenario 1

If price falls below 5800 then I would target 5775 - 5725. At approximately 5750, I would expect buyers to step and price to revert higher.

Scenario 2

If price moves above 5875 - 5900 then I would target 6000. I expect price to mean revert here.

To compute the S&P 500 cash values, just subtract 50 from the S&P 500 futures to get the equivalent prices.

Have a successful trading week, by waiting for your trade setups to come to you. Always manage your risk and understand what you expect to lose prior to trade entry. By managing risk, you unlock profitability.

Gamma Level data (netgex data) and skew data (market sentiment) was provided by menthorQ.com

How I trade

I did a presentation of my trading process with menthorQ on how I trade the S&P 500. You can watch it here.

Disclaimer

Please don’t follow my idea(s) blindly. Do your own due dilligence before you attempt to trade. Again, always manage your risk.

Thank you for reading my weekly plan.

Joel