Weekly Plan for June 29

The SPX squeezed higher for 4 percent move last week. Does the index have any gas left in the tank?

Summary

After a 1,110-point rally from April 9 through May 14, the S&P 500 entered a classic digestion phase. For four weeks, futures traded sideways in a roughly 300-point range between 5,735 and 6,075. Last week, that consolidation ended as the cash index convincingly broke out to the upside, climbing nearly 4 percent. The cash index closed at 6,173.

This is a holiday-shortened week, with the Fourth of July holiday concluding the week on Friday.

Volatility continued to decrease throughout the week. Price has one time framed higher last week with momentum moving into overbought levels.

Below is the daily chart of the S&P futures, showing price making higher highs. The white dots point to the PSAR indicator (trend indicator), showing the upward trend has recovered.

Even with the geopolitical action, tarriffs, the S&P mostly ignored the noise this past week. Until a weekly bar finally breaks its predecessor’s low, the dominant bias stays up.

In the sections below, I’ll walk through a range of data points that support both the bullish and bearish narratives heading into the upcoming week.

There really isn’t a bearish narrative from a data perspective until price breaks through key support areas. For this week, I expect price to pause and consolidate last week’s large move.

From a big-picture perspective, the S&P 500 is trading at the following multiples:

Trailing (TTM) P/E: 25.19 (calculated on June 27, 2025; source: WorldPEratio.com)

Forward P/E: 27.16 (as of June 30, 2025; source: YCharts.com)

These levels sit above longer-term historical averages (the five-year average trailing P/E is approximately 21.9), reflecting elevated current valuations.

Using the current S&P 500 level and trailing earnings, we can back out the index value at a 21.9× P/E:

Derive trailing EPS = 6173 / 25.19 == 245.1

EPS = Index Level / Trailing P/E

Compute index at 21.9× P/E

Target Index=EPSTTM×21.9=245.1×21.9≈5,369

Conclusion:

At a 21.9× trailing P/E multiple, the S&P 500 would trade around 5,370.

Therefore, from a valuation viewpoint, we can conclude that the S&P 500 is extremely overvalued.

As I trade week to week, primarily focusing on price action and participant positioning, I use valuation as a bearish data point. I don’t employ it for short-term trading decisions. At some point, positioning and pricing information will revert to historical norms, and I will trade accordingly.

I post weekly market updates, and you can find all of them here.

We begin with the S&P 500 futures monkey bars chart, incorporating both price action and positioning data to outline a trading plan for the week ahead. The monkey bar chart incorporates volume profile which provides clues into the current auction process.

📊 S&P Daily Volume Profile chart

The image below shows a ThinkOrSwim Monkey Bars chart from last week, which combines volume data with market-profile information. My analysis concentrates on the volume-profile section. The pink bars on the left mark the Point of Control (POC)—the price level that attracted the greatest trading volume during the selected period. You can get a definition of it here. There are plenty of sources on the internet and books which provide excellent insight into its value.

I missed a key nuance in the 6/16 - 6/20 chart below: the arrow shows that the entire price bar was above the previous day’s bar, indicating that a potential trend change was occurring.

For the week 6/23 - 6/27 here are the key details below:

Price consolidated for one day and moved into the previous week’s balance.

For 6/23 - 6/27 price gapped higher and value continued to move higher for the entire week.

Progressive POCs rising day-over-day = clear bullish auction.

Single-print areas mark where price moved quickly; these become support on a retest.

Prior POCs flip to support once price sustains above.

Conclusion & Trade Signals

Bullish bias confirmed by POC progression higher and accepted value at higher levels.

Look to buy pullbacks into 6,135–6,170 and 6,090–6,145 zones.

A break back below 6,090 (06/16 POC) would be the first sign that this uptrend may be losing steam.

Read about market profile and auction market theory here.

Current Market Outlook Using Sectors

🔺 Broad Market Sector Summary

Cyclicals (Comm. Services, Tech, Discretionary, Financials, Industrials) led the charge.

Defensives (Staples, RE, Energy) underperformed, with Energy down over 4%. Energy is a relatively small portion of the S&P 500, approximately 3%.

Market leadership remains in growth-oriented, rate-sensitive sectors, while yield-linked groups lag.

Consumer Discretionary and Consumer Staples are the two consumer-related sectors, with Discretionary displaying a clear risk-on bias.

📉 VVIX Chart

The VVIX is the CBOE volatility of volatility for the S&P 500. Whereas the VIX measures the market’s expectation of SPX volatility over the next 30 days, the VVIX measures the market’s expectation of how much the VIX itself will move over the next 30 days.

This index can signal potential turning points when an ongoing trend may mean revert.

How to interpret it

Rising VVIX often precedes or accompanies spikes in the VIX itself, signaling that volatility may accelerate (even if VIX is currently low).

Falling VVIX suggests implied volatility is calm and that VIX is likely to grind sideways or drift lower.

VVIX sits near the bottom of its one-month range and below its 20-day MA, with ultra-narrow Bollinger Bands—implying very muted expected moves in the VIX itself.

📉 VIX Summary & Implications for SPX

What This Means for SPX

Bullish Backdrop: Low and falling VIX typically accompanies rising equities—investor complacency fuels continued up-moves in the S&P.

Tighter Ranges Ahead: With expected daily VIX swings of only ±0.12, SPX is likely to trade in a narrower band until a volatility catalyst arrives.

Complacency Warning: VIX near multi-month lows can precede sharp volatility spikes. Keep an eye on macro/data catalysts (e.g., CPI, Fed speak) as potential inflection points.

Trade Signals:

Buy SPX pullbacks into support zones, with vol hedges kept light.

Consider short-dated vega-positive trades (e.g., credit spreads) to collect premium in a low-vol environment.

Watch for VIX reversal signals (break above its 20-day MA or Parabolic SAR flip) as an early warning of SPX downside risk.

The MenthorQ SMILE curve

The MenthorQ skew smile curve chart of the S&P 500 cash index.

🧭 Key Observations

Mild pull-back in tail‐risk premium vs. 5 days ago

The red curve (5 D ago) sits just above today’s on the deep-OTM put wing (< 4 000 strikes), so the extra cost for crash protection has eased slightly.Flat ATM vols (~11–12%)

All four curves converge around the 6 000–6 200 strikes, so traders aren’t expecting a big move in SPX through the holiday week.

S&P 500 Term Structure

The chart below shows the $SPX term structure. The green line represents today’s curve, which is lower than it was over the past five days—signaling price consolidation. As the week progresses, the curve rises relative to last week, indicating an impending volatility shock.

1. Compressed Front‐End Moves

1–5 day vols at 8–10% → expected one-day SPX moves of only ~1.6–2.0%.

Minimal term premium between today and 1 week out means there’s little extra cost to push exposure a few days further—volatility markets are pricing in hardly any “event risk” through July 4.

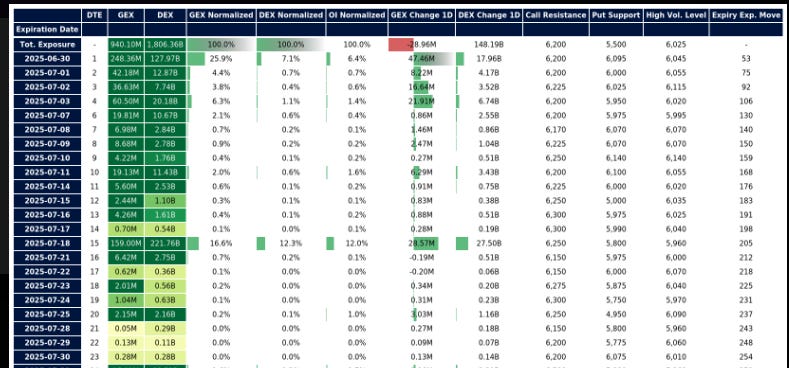

S&P 500 Cash Gamma levels

The chart shows the positioning information over the next couple of weeks. It is heavily skewed to the upside.

Gamma SPX Summary

Front-end dominates gamma:

June 30 (DTE 1) alone accounts for ~26% of all SPX gamma, so dealer hedging will be heaviest around today’s close.

July 3 (DTE 4) is the next largest gamma bucket (~6.3%).

Static call walls:

A 6,200 call wall sits on most expiries (6/30, 7/1, 7/3), with a slight uptick to 6,225 for July 2. Expect spot to meet some resistance in that zone.

Decaying put support:

Immediate support starts at ~6,095 for today, then steps down to ~6,000 and ~5,950 later in the week.

Expected moves widen:

Expiry‐implied ranges grow from ~53 pts (6/30) to ~106 pts (7/3), reflecting how time and front-end vols expand.

Overnight gamma pick‐up:

GEX for 6/30 jumped by +47 M yesterday—be ready for sharper dealer hedging flows into today’s close.

Economic Events for the Week

Here are the key economic events for the upcoming week, all times Eastern.

Here are the highest‐impact economic releases and speeches likely to drive volatility in U.S. markets this week (Jun 30–July 3):

Monday, June 30

Chicago PMI (June) at 9:45 am ET

Pending Home Sales (May) at 10:00 am ET

U.S. Treasury 2-Year Note Auction at 1:00 pm ET

Tuesday, July 1

JOLTS Job Openings (May) at 10:00 am ET

U.S. Treasury 5-Year Note Auction at 1:00 pm ET

Wednesday, July 2

ADP Employment Change (June) at 8:15 am ET

ISM Services PMI (June) at 10:00 am ET

U.S. Treasury 7-Year Note Auction at 1:00 pm ET

Thursday, July 3

Initial Jobless Claims at 8:30 am ET

Factory Orders (May) at 10:00 am ET

Pre-Holiday Treasury Bill / Coupon Auctions (2- and 3-year reopenings)

Friday, July 4

U.S. Markets Closed for Independence Day

Every Day

Geopolitical risk

📉 Key Points

Low liquidity into the long weekend (July 4) can exaggerate moves around these prints.

The big macro data (ADP, ISM Services) on Wednesday are the main catalysts—followed by jobless claims on Thursday before the holiday.

Treasury auctions each day will also drive intra-day flow, especially with heavy front-end gamma in SPX

NQ Futures Daily Chart

Looking at the QQQs or the Nasdaq100 futures are an important part of my trading plan. The XLK (technology ETF) represents a 33% component of the S&P500. Therefore I use this as an indicator to trade the S&P 500.

When both futures (e.g., S&P 500 and Nasdaq) align in the same direction, the probability of the prevailing price trend continuing increases.

For example, during the rally in early May 2025, both ES (S&P futures) and NQ (Nasdaq futures) moved higher in tandem—confirming bullish momentum and leading to a sustained uptrend across major indices.

⚠️ Key Takeaways

Momentum & Extension

Today’s +141.75-point gain pre-market marks a fresh multi-month high, reinforcing bullish conviction.

Given the length of this third wave, look for a mild pullback (a “wave 4” correction) to either the 22,150 pivot or the PSAR (~21,750) before the trend resumes.

Immediate Support & Resistance

Support: PSAR / lower trend line ≈ 21,750; horizontal pivot near 22,150.

Resistance: recent high near 22,915 (today’s close) and the upper channel line around 24,300.

QQQ Gamma levels

The chart below shows the positioning information for QQQ. The QQQ is the ETF for nazdaq 100.

📌 Summary Outlook for QQQ

Gamma Concentration

6/30 (DTE 1) controls ~21% of QQQ’s total gamma → biggest dealer‐hedge day into today’s close.

Next heaviest is 7/3 (DTE 4) at ~13%, so gamma burden shifts there after rollover.

Pin & Resistance Zones

550 is a clear upside pin for the first three expiries; on Thursday the call wall shifts down to 545.

Downside support steps from 541 → 539 → 538 → 525 as you move through the week.

Expected Moves Are Tiny

Today’s one‐day move is only ~6 pts (≈0.3%), widening modestly to ~12 pts (0.6%) by Thursday.

Implies a very narrow trading range on the thin holiday tape.

Directional Flows

Yesterday saw –27 M gamma change for 6/30 (dealer selling), then +443 M in directional exposure—expect choppy, reactive flows.

Positive DEX changes on 7/1–7/3 (up to +358 M) suggest continued delta‐hedging pressure around those expiries.

QQQ Option Matrix: Key Takeaways (June 30–July 3)

🧠 Implications for SPX (Correlation View)

If QQQ breaks above 550 with sustained delta‐hedging, look for SPX to test and breach 6225 resistance.

If QQQ drops below 541, SPX is prone to slide toward 6 050–6 075 support clusters.

Use real-time relative strength in QQQ vs. SPX to tilt your bias: tech weakness = broader market caution; tech strength = broader market continuation.

Management of last week’s plan

Last week I was short bear call spreads and they were hedged with long calls.

This week I am cautiously bullish. After a 280 point up move in the SPX, entering a long here would be at a poor location. I have a long dated hedge at this time with the expectation that price may mean revert.

You can review all of my posts here.

The Weekly Plan and trading idea

My general strategy for the current market is limit the weekend exposure to the market. With that being said, I am generally more than 75 percent in cash on any given weekend.

Since the market has become bullish, i would look for only bullish strategies. I would wait for price to make a small pullback prior to entry. For this week, I expect mean reversion from all time highs.

For S&P 500 futures analysis, I used the ESU25 contract (expires in September). I treat NQ and QQQ interchangeably in my analysis, and all trades are executed in SPX.

Sample trade ideas:

SPX-focused trade ideas for the week.

Iron Condor into the end of week (July 3)

Sell 6 100 P / Buy 6 075 P

Sell 6 250 C / Buy 6 275 C

Rationale: Extended move in the SPX over the previous 5 days ( 280 points higher). Expect mean reversion. Sell above the CALL wall.

Call Calendar Spread

Sell Jul 3 6 200 C • Buy Jul 11 6 200 C

Rationale: Buying vega positive tail hedge.

Positioned at the dealer call wall.

Key Summary:

Value has to continued to make higher highs. Look for consolidation into this holiday shortened week.

Have a successful trading week.

Let your trade setups come to you—don’t chase. Remember to size down your trades and always define your risk in advance. Patience and size discipline are edge amplifiers, especially in high-volatility environments.

Managing risk is what keeps you in the game; discipline is what makes you profitable.

Gamma Level data (netgex data) and skew data (market sentiment) was provided by menthorQ.com

Presentation on GOLD

I did a presentation on trading gold June 17.

You can watch it here:

How I trade

I did several presentations with menthorQ. You can find them here. This is under the highlights section of my “x” account found here.

Follow me on X formerly twitter . I post my market view during the week.

Disclaimer

The trade ideas provided are for educational purposes only. These ideas are based on the analysis I have performed. Make sure you do your own due dilligence prior to taking on any risk! Always manage your risk.

Thank you for reading my weekly plan.

Joel