Weekly Plan for November 17

S&P 500 has fallen in three of the last four weeks. The one up week was the election week. Last week the S&P retraced half of the previous week's gain. Below I will go into my weekly plan.

Summary

The election euphoria took a downward turn last week. The S&P opened at the high and closed at the low. For this week, I expect to see continued downward price movement.

S&P 500 Futures Daily

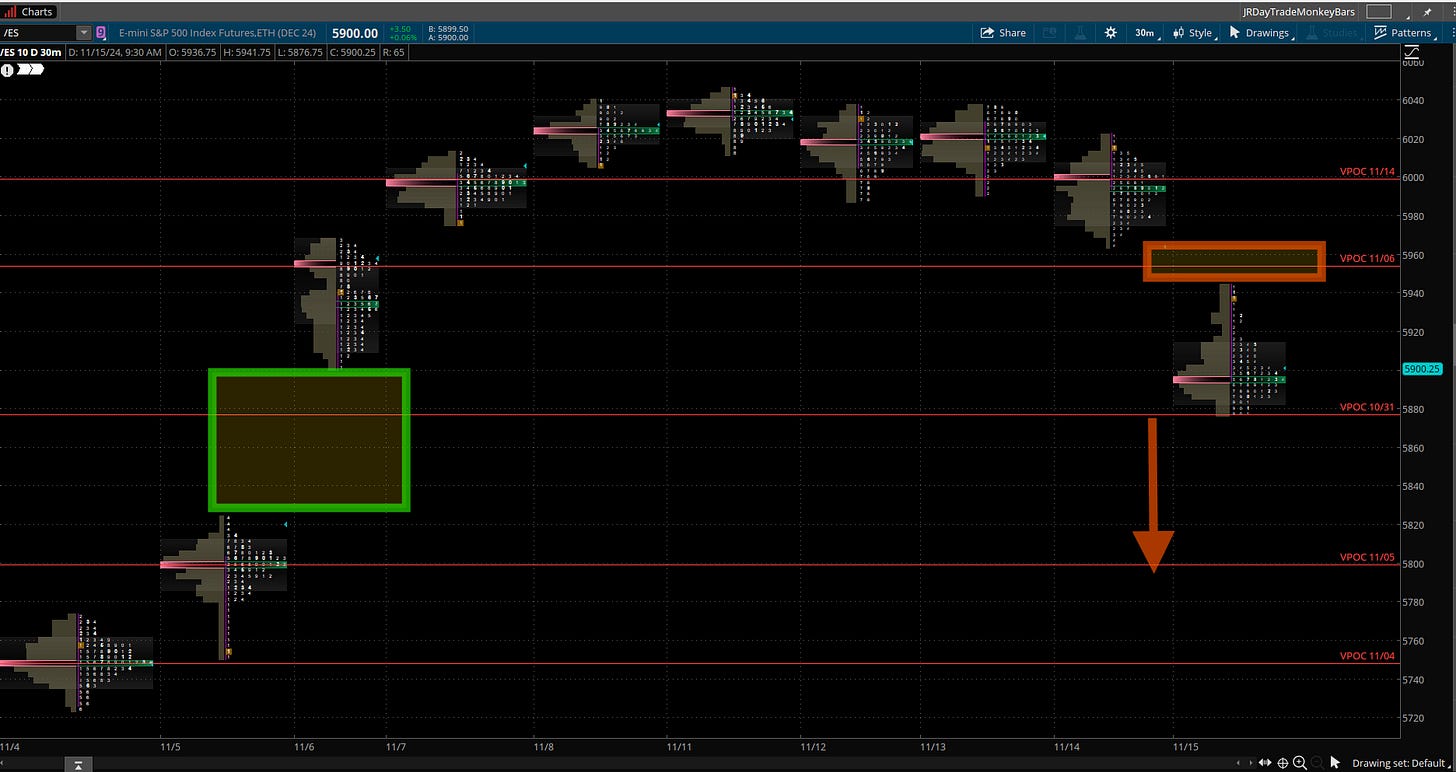

The chart below represents the S&P futures volume profile chart. The green rectangle on the left is the large gap up resulting from the election results getting resolved without delay. The gap down on the right side highlighted with a red rectangle shows part of the move giving back. This was Friday’s price action. Also note that the S&P made a poor low. Therefore I expect lower prices earlier in the week. I drew a potential target. The target is significant in two ways:

The 50 day SMA.

The point of control from 11/5.

The daily S&P futures chart. The arrow points to the 50 SMA.

S&P 500 Futures Weekly

The price potentially targets the 8 week SMA shown below. The 8 week SMA is the green price line.

Ultimately, if these levels are hit, I would view them as good levels to buy the market.

The U.S. market has a number of catalysts this week, therefore there is a lot of opportunity for volatility.

The market maker implied move for the S&P futures this week is +/- 98 points.

Market sentiment has moved to the neutral area, however it did move lower from greed to neutral based on the CNN Fear & Greed Index in the last week.

US Market Moving Events

For the week of November 18, 2024, several significant events could impact the U.S. stock market:

Economic:

Monday (11/18): NAHB Housing Market Index

Tuesday (11/19): Housing Starts, Building Permits

Wednesday (11/20): MBA Mortgage Applications Index

Thursday (11/14): Initial & Continuing Claims, Leading Index, Existing Home Sales

Friday (11/15): S&P Global Manufacturing & Services PMI, U of Mich Consumer Confidence

Earnings:

Tuesday (11/19): Walmart Inc. (WMT), Medtronic (MDT), Lowe's Companies Inc. (LOW), Weibo Corp. (WB)

Wednesday (11/20): Target Corp. (TGT), Williams-Sonoma Inc. (WSM), NIO Inc. (NIO), TJX Companies Inc. (TJX), Nvidia Corp. (NVDA), Palo Alto Networks Inc. (PANW), Snowflake Inc. (SNOW)

Thursday (11/21): Deere & Co. (DE), Baidu Inc. (BIDU), Intuit Inc. (INTU), Copart Inc. (CPRT), Ross Stores Inc. (ROST), Gap Inc. (GAP)

Friday (11/22): Buckle Inc. (BKE)

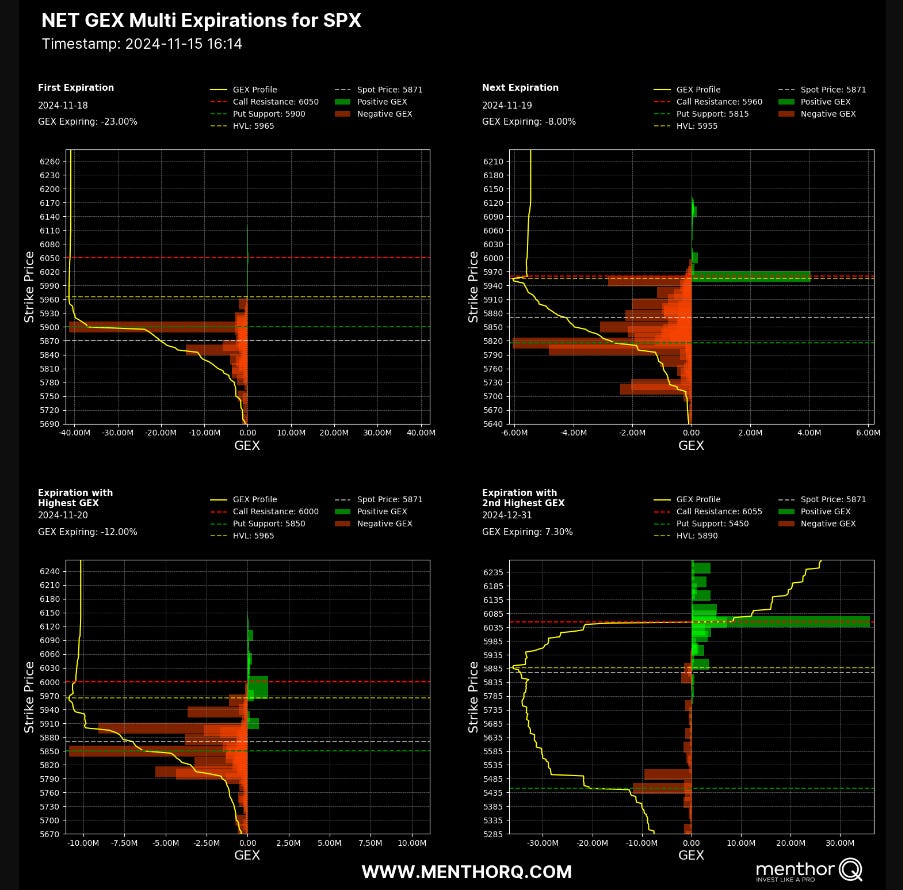

S&P 500 Cash Gamma levels

For next week market participants are mostly bearish. 5960 - 5960 is the area where the goes from bearish to bullish.

At some point later in the week i expect a short covering reversal to the upside. I also expect that there will be an end of year rally. This is noted by the bullish positioning for the end of December 2024.

NQ futures daily Chart

The NQ futures shows a similar pattern to the S&P 500 futures. Note the gap up after the election and the gap down on Friday November 15. The arrow points to 20250 zone. The is 50 day SMA line. I expect a potential bounce higher here. A key event for the Nazdaq are the NVDA earnings and forward guidance.

NQ futures Weekly Chart

The weekly price movement nearly took back the entire election euphoric move higher.

I primarily trade SPX (S&P 500 cash index). Since the Nasdaz 100 represents 30% of the S&P 500, I view it as an important influence on the direction and or movement in the S&P 500.

The Weekly Plan

The S&P 500 took back a large portion of the election upward move. Currently S&P 500 price is in the middle of the range. I will wait for price to complete the downward move before entering a long trade.

Sample Weekly Idea

If price remains below 5960: i will sell call spreads above the most recent high. I will select a date approximately 1 week out.

If price above 5960: I sell put spreads below 5650. approximately 1 week out.

Have a successful trading week, by waiting for your trade setups to come to you.

Thank you for reading my weekly plan.

Gamma Level data (netgex data) was provided by menthorQ.com

Disclaimer

Trading involves Risk. Please don’t follow my idea blindly. Do your own due dilligence before you attempt to trade.

Always manage your risk.

Joel