Weekly Plan for November 24

S&P 500 moved 1.6% higher the previous week. The current week is shortened by Thanksgiving holiday. I expect trading volume to be lighter. I will go into my weekly plan below.

Summary

The S&P moved out of a small consolidation to the upside. The move higher was not an impressive move higher (It showed low volume accompanied by a small price move higher). Most market participants expect a continuation of the move with prices moving higher this week due to Thanksgiving holiday(Thursday) and a half day session on Friday.

S&P 500 Futures Daily

The chart below represents the S&P futures volume profile chart. There are a number of nuances in the chart below. The highlighted rectange to the right shows a four day balance. On Thursday, price broke the balance to the upside. Friday made a small continuation higher. The volume point of control ( 6000 on 11/14/2024) was not touched. A stronger market should have tagged this level.

The lower end of the balance area ( approximately 5880) was touched four or five times during the previous week. Each time price touches a price zone, the price support or resistance becomes weaker. A subsequent move to the area will cause it to break.

The green rectangle on the left is the large gap up resulting from the election results getting resolved without delay. Eventually this price gap will get tested. Also note that the S&P made a poor low on Thursday.

The daily S&P futures chart.

This chart shows the trendline drawn from 4/19/2024 low. At high in July ( 7/16/2024) price was extended approximately 10 % above this trendline. Currently price is 11% extended above this trendline. Potentially, price could revert to the mean ( the trendline).

As an initial area to touch would be the 5900 area, followed by the 5850 - 5870 zone. This area was tested from 10/31 - 11/05

If price continues to revert downward then it could tag the 5700 - 5750 area. This was an area tested extensively from 9/19 - 11/5

The ultimate price objective would see the 5300 area. I don’t think it will happen in one day, however it could happen over a number of weeks.

I point this out as it is a contrarian view. The default view is that price will move higher.

S&P 500 Futures Weekly

I have drawn a fibonacci extension where the starting point is 10/30/2023. This the begining of the current major bullish leg higher. The week of 11/11 price hit the 61.8 extension level. This price was 6045. Last week price bounced multiple times off the 50.0 level. This price is 5905.

The market maker implied move for the S&P futures this week is +/- 65 points.

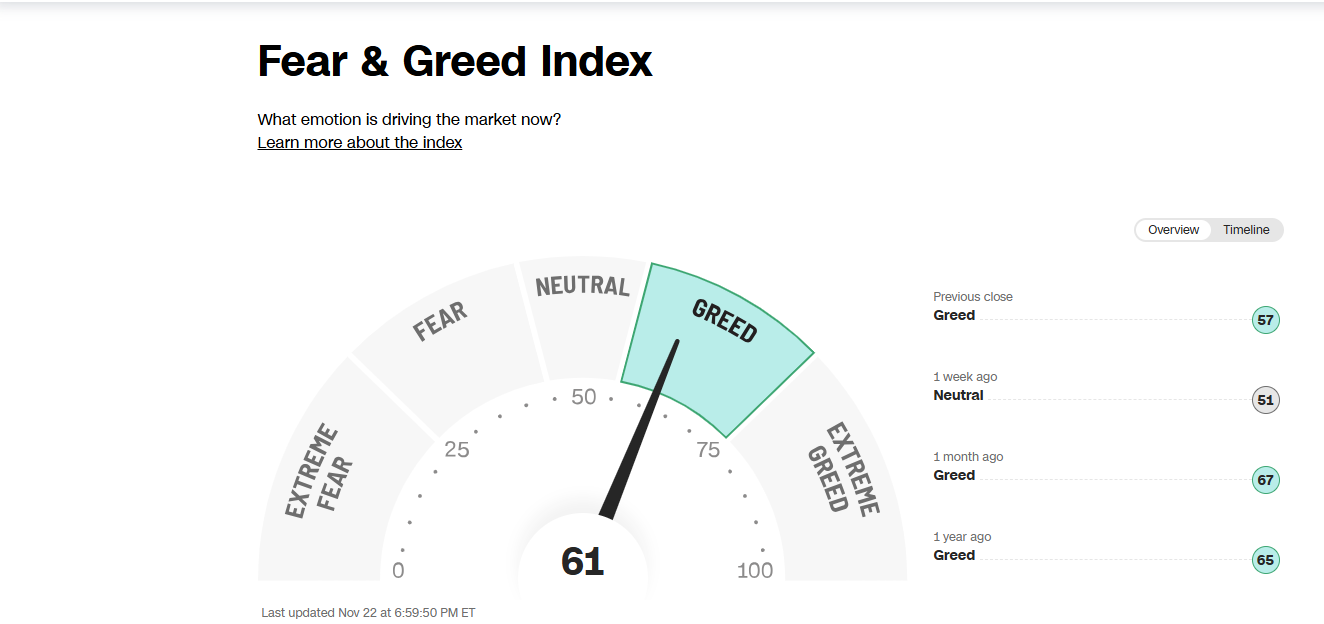

Market sentiment has moved higher to greed from the nuetral zone. This is depicted from last week’s CNN Fear & Greed Index.

US Market Moving Events

The market moving events for the week of 11/24/2024

1. Retail Earnings Reports: Major retailers are scheduled to release their quarterly earnings, providing insights into consumer spending trends ahead of the holiday season. Companies such as Macy's, Nordstrom, Gap, and Target are among those reporting. These results will offer valuable information on consumer behavior and economic health.

2. Economic Data Releases: Midweek, the U.S. will publish significant economic indicators:

Personal Consumption Expenditures (PCE) Inflation Index: This measure of inflation is closely monitored by the Federal Reserve and will provide insights into price pressures in the economy.

Revised Third-Quarter GDP: An updated estimate of the nation's economic growth during the third quarter will be released, offering a clearer picture of economic performance. Additionally, the Federal Reserve will publish minutes from its November meeting, potentially shedding light on future monetary policy decisions.

3. Thanksgiving Holiday Impact: The Thanksgiving holiday will affect market activity:

Market Closures: U.S. markets will be closed on Thursday, November 28, and bond markets will close early on Friday, November 29.

Holiday Travel and Consumer Spending: Record levels of Thanksgiving travel are anticipated, which could influence consumer spending patterns and, by extension, retail sector performance.

4. Technology Sector Earnings: Several technology companies are set to report earnings, including Dell Technologies, HP, CrowdStrike, and Analog Devices. Their performance will be closely watched for insights into the health of the tech sector and its impact on the broader market.

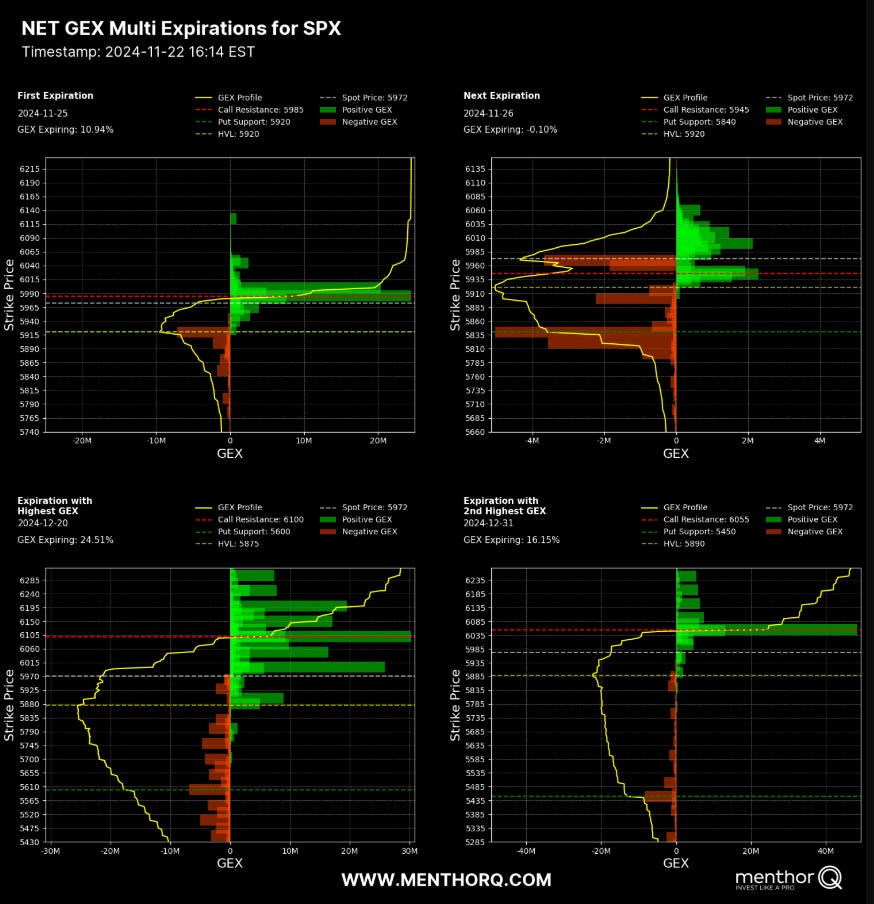

S&P 500 Cash Gamma levels

For the current week market participants are mostly bullish. If price breaks 5940 - 5920 zone then S&P 500 cash index goes from bullish to bearish positioning. The S&P cash index closed at 5969.

As noted earlier, the market is very thin (light volume) therefore I expect a lot of movement for the week. That is both up and down.

NQ futures daily Chart

The NQ futures are currently sitting on the trendline drawn from 8/6/2024 low. The previous week showcased NVDA earnings. The earning were extremely good however the stock sold off. Is it possible that NVDA has peaked?

Thirty percent of the S&P 500 is represented by technology. The nazdaq made a an all-time high 11/13/2024.

NQ futures Weekly Chart

I have drawn the fibonacci extension from the 11/20/2023 low. This was the swing low for the most recent leg up for the Nazdaq futures. The 100% extension terminates at 21400. The Nazdaq futures closed Friday at 21293.

The Weekly Plan

The S&P 500 made a inside week. Price closed within the previous week’s price range. The low of the previous two weeks were within a few points. The low is 5875. Breaking this low should generate a significant down move and potentially close the election week gap up.

I am currently nuetral to slghtly bearish for the week. I am currently in bearish call spreads in the S&P 500. This spread is placed above the all time high.

Sample Weekly Idea for S&P futures

If price is below 5900: i will take a bearish view and go long a bearish put spread.

If price is in the range 5900 - 6040: then I am nuetral on the S&P 500.

If price is above 6040: I will take a bullish view and go long bulliish call spread.

Have a successful trading week, by waiting for your trade setups to come to you.

Thank you for reading my weekly plan.

Gamma Level data (netgex data) was provided by menthorQ.com

Disclaimer

Trading involves Risk. Please don’t follow my idea blindly. Do your own due dilligence before you attempt to trade.

Always manage your risk.

Joel