( Revised )Weekly Plan for December 22

Is the S&P 500 setting up for a year end rally? Let's get into the my weekly plan.

Summary

An error was made in the calculation of the weekly trade. It is updated and italicized and bolded below.

The market is in a seasonally bullish period however last week the S&P 500 experienced a large amounts of volatility. A 180 points move down on Wednesday and Thursday coupled with an up move on Friday of 80 points.

On Wednesday, the FOMC announced a 25 basis cut to short term rates, however the press conference after indicated that there would be less interest rate cuts in 2025. This was perceived as hawkish and major players took the S&P down by 3 percent within the last two hours of the trading session.

Management of last week’s plan

In last week’s plan, I was positioned in a set of neutral trades for S&P 500. The market was in balance and was looking for a signal, that balance was breaking. I got that signal on Tuesday and closed all the short PUT trades. By end of day, I was holding only the short calls in the SPX.

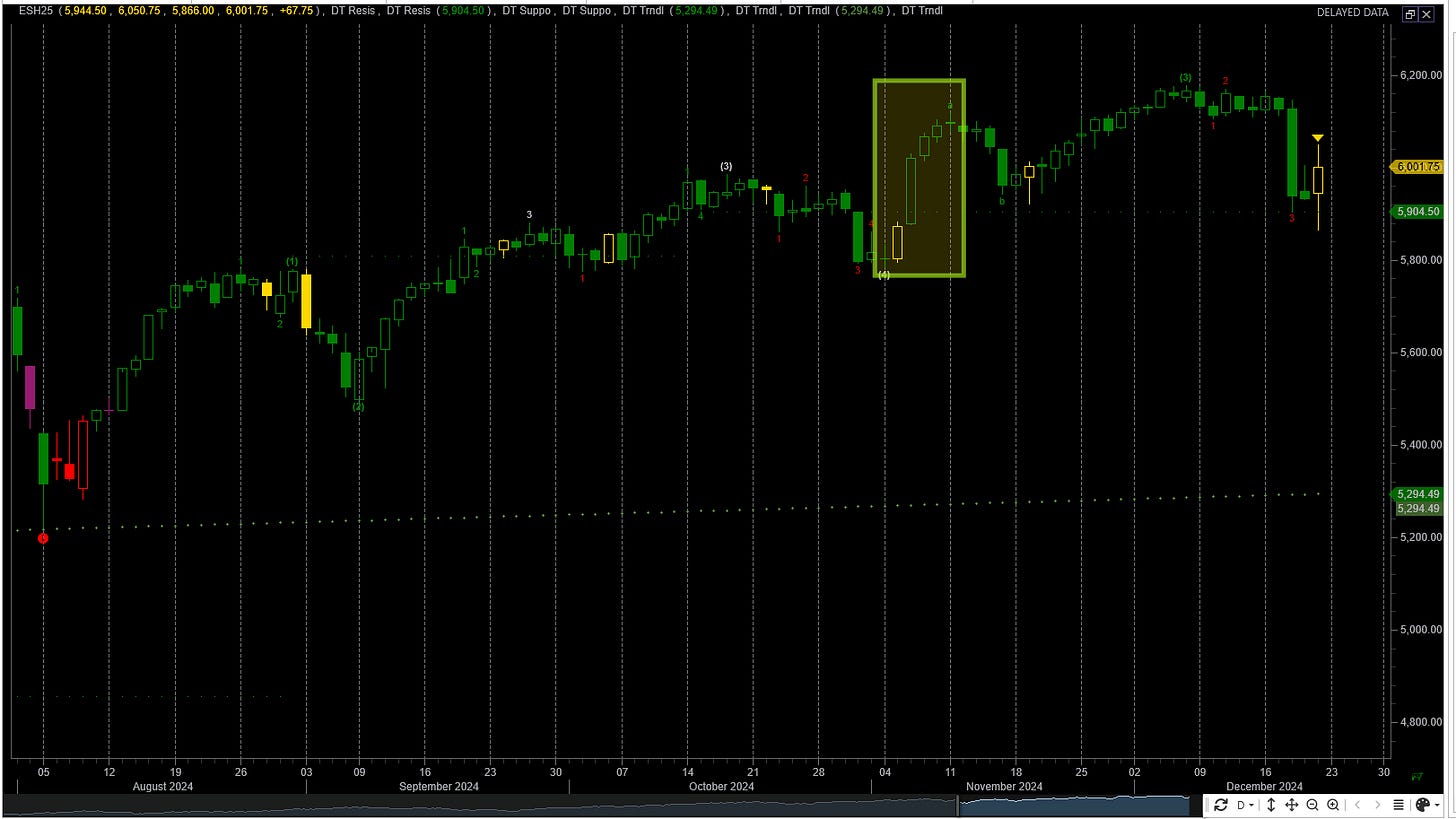

The image below is the volume profile. I have circled Tuesday’s action in yellow. I observed a lower point of control as the day moved. This indicated selling and price was moving out of balance lower. Additionally, the short puts have not lost any value since I entered the trade ( shorts puts means that the trade’s profitability is increasing). Therefore I closed out this part of my position. I kept the short calls as this part of the trade continued to work.

The short calls had little value remaining and were closed out for maximum profit.

The large oval represents the action on Wednesday (FOMC day). The action was highly emotional as it lacked very little back and forth filling. I have labeled the three areas. Each one of those areas can be viewed as a single day of trading from the viewpoint of market profile.

Thursday's action saw a lower point of control and the day’s price action was an example of an inside day.

On Friday, there was snap back rally. The action also was highly emotional with single prints between 5935 - 5958.

S&P 500 Futures Daily

The election rally was approximately a 4% upward move. This price action has been taken back with the recently. I have highlighted where the rally has begun. I believe this is more of a neutral to bearish signal for the S&P 500 longer term.

The market is now in a very large trading range defined from 5795 - 6178.

The Weekly S&P futures chart.

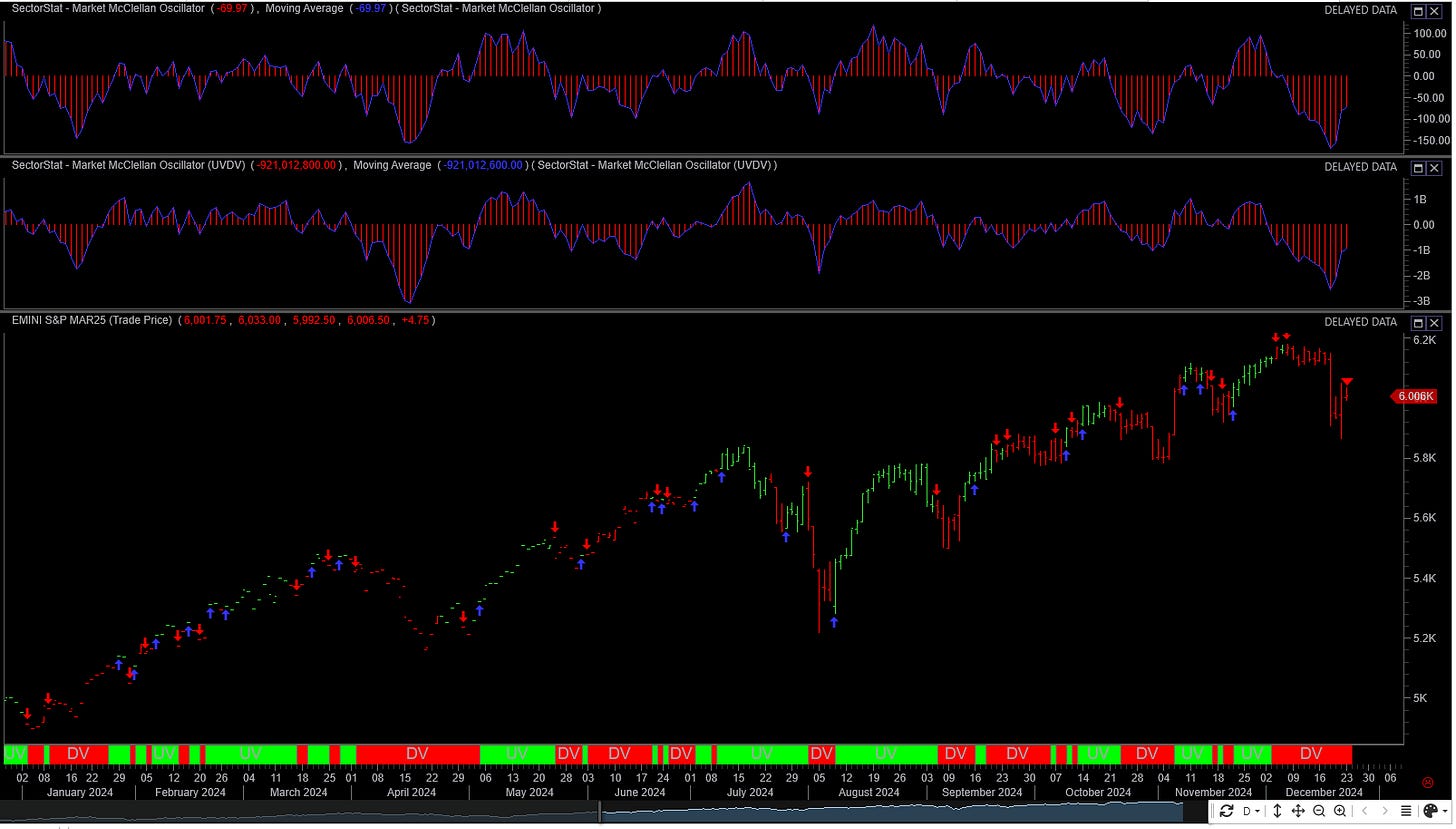

Both market and volume sentiment continues to stay bearish over the last week of trading. This is depicted by the chart below. This chart shows the McClellan Oscillator. The two histograms in chart represent market and volume sentiment. The S&P 500 price is shown in lower section of the chart.

The S&P 500 Skew is shown here. The highlighted area shows the skew at extreme bearish levels. A reversal happens shortly thereafter. On Friday, S&P 500 moved higher 1 percent after Wednesday’s and Thursday market 3 percent drop. I have circled other recent times where S&P 500 appeared at extreme bearish levels. Within a couple of days of hitting the peak, the S&P500 reversed higher.

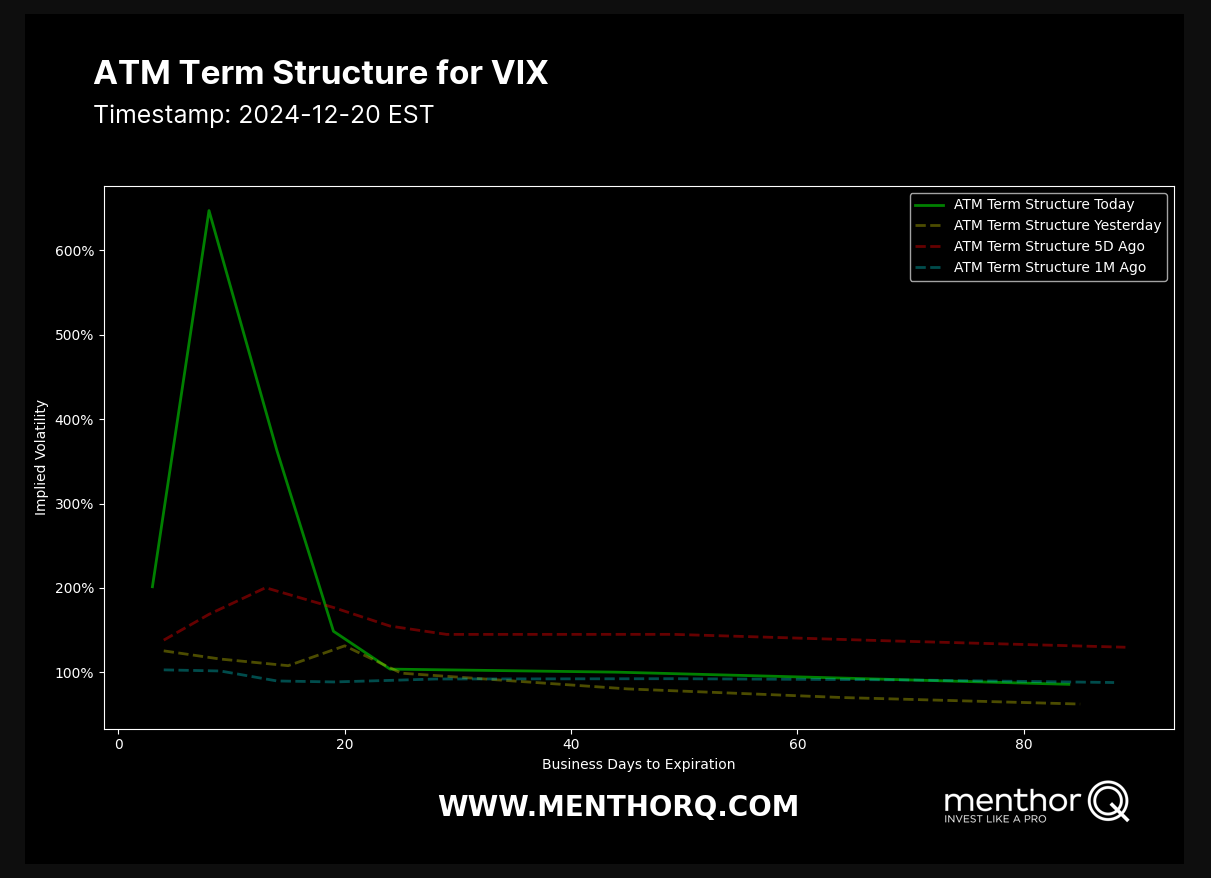

VIX term Structure

The vix is currently in backwardation. This implies that near term volitality is higher than next month’s volatility. Moves in the SPX will be larger than when the VIX is in contango. The expectation is that VIX will revert to contango which is bullish for the S&P 500. Based on the chart, it is expected to occur within the next 15 trading days.

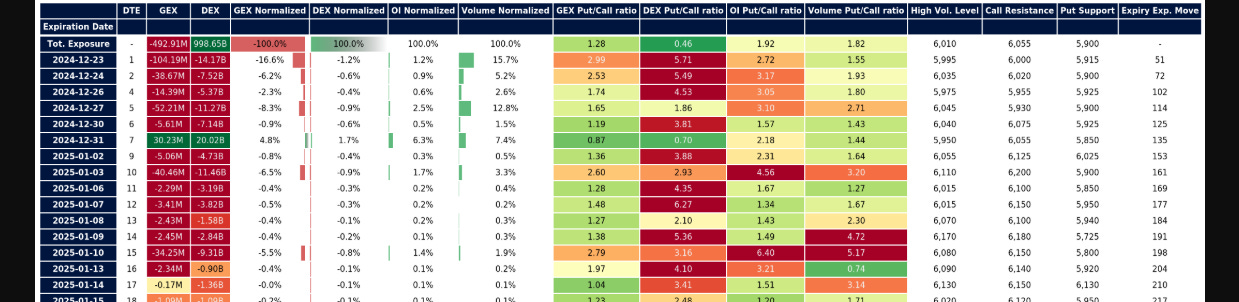

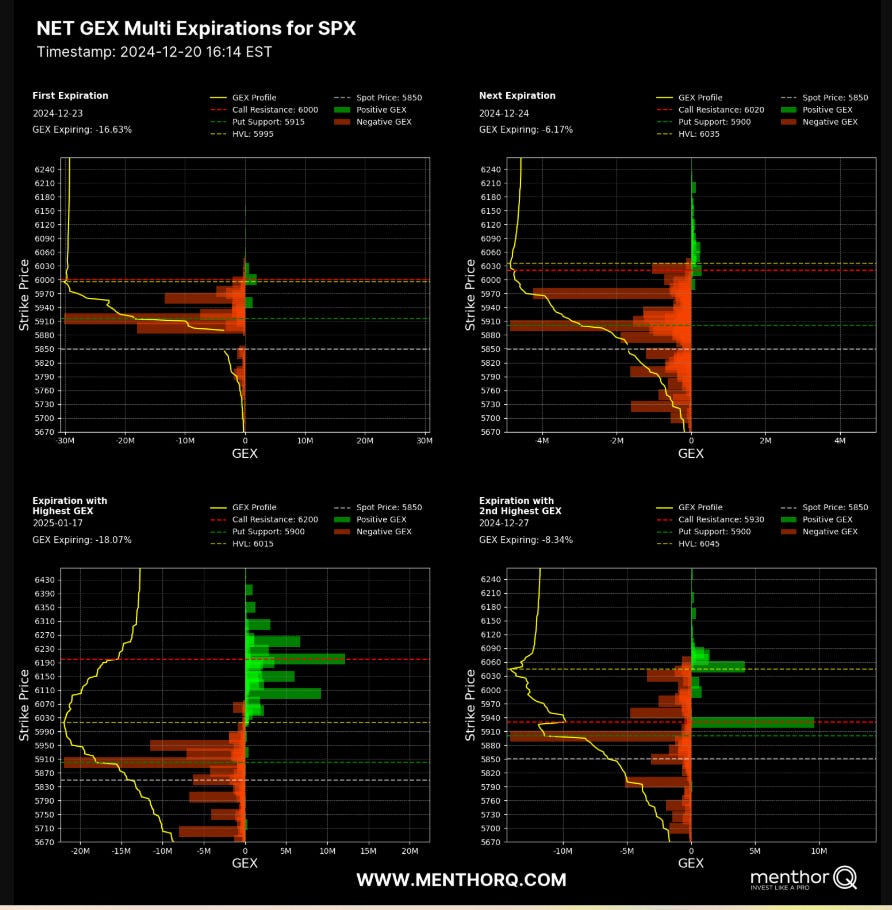

S&P 500 Cash Gamma levels

For the current week market participants are positioned mostly bearish. If price breaks below the 5920 - 5925 zone then S&P 500 cash index could fall to an area between 5850 - 5825.

Above 5990 - 6010 zone, positioning is supportive of a bullish narrative. A potential target is 6100. This is the top of the most recent consolidation range.

The chart below shows extreme bearishness for both this week and next.

Market makers are positioned to trade in the direction of the market. This is due to the negative gamma effect. This implies that moves both up and down will be large and extreme. This is period of time to trade smaller size.

The market maker implied move for the S&P futures this week is +/- 87 points. Therefore the market maker expected range is between 5843 to 6017.

US Market Moving Events

The market moving events for the week of 12/23/2024

This week, December 23–27, 2024, is expected to be relatively quiet in the financial markets due to the Christmas holiday. Here's an overview of key events and economic data releases to watch:

Monday, December 23:

Consumer Confidence Index: The Conference Board will release its December reading, with expectations around 113.0, indicating consumer sentiment during the holiday season.

Durable Goods Orders: The Census Bureau will report on November's durable goods orders, with forecasts suggesting a 0.3% decline, reflecting business investment trends.

Tuesday, December 24 (Christmas Eve):

New Home Sales: Data for November is anticipated, with an expected 9% increase from October, signaling trends in the housing market.

Market Hours: U.S. stock markets (NYSE and Nasdaq) will close early at 1 p.m. ET, and bond markets will close at 2 p.m. ET.

Wednesday, December 25 (Christmas Day):

Market Closure: All U.S. financial markets will be closed in observance of the Christmas holiday.

Thursday, December 26:

Initial Jobless Claims: The Department of Labor will release data for the week ending December 21, providing insights into the labor market's health.

Friday, December 27:

Retail Inventories and International Trade: The Census Bureau will release advance reports on retail inventories and the trade balance for November, offering indications of economic activity and trade dynamics.

Given the holiday-shortened week, trading volumes may be lower, potentially leading to increased market volatility. Investors should stay informed about these economic indicators, as they provide valuable insights into the economy's performance during the holiday season.

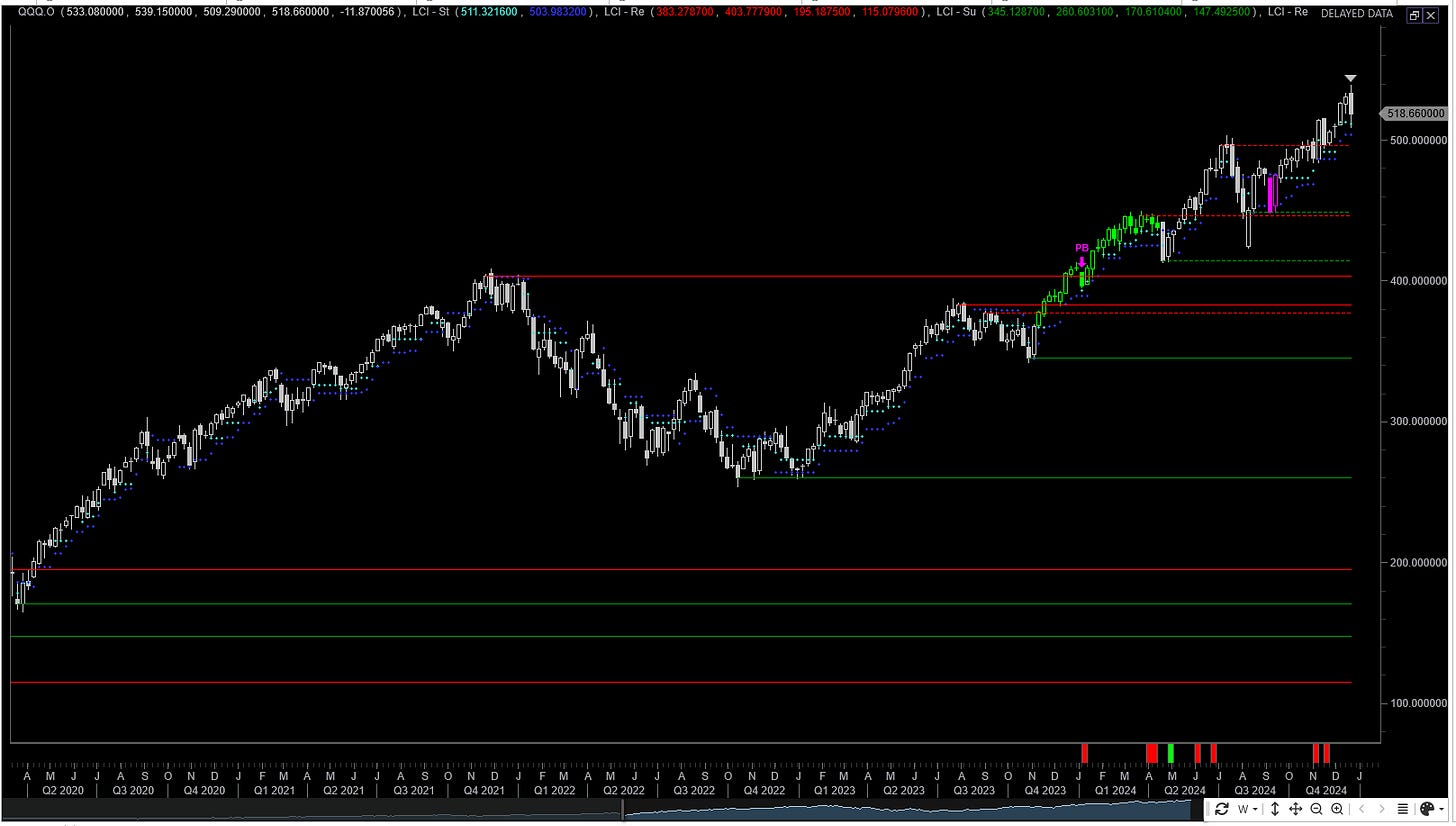

QQQ Weekly Chart

Looking at the QQQs or the Nazdaq 100 futures are an important part of my trading plan. The XLK (technology ETF) represents a 33% component of the S&P500. Therefore I use this as an indicator to trade the S&P 500.

The QQs made a bearish engulfing pattern on the weekly chart. This generally foretells more weakness.

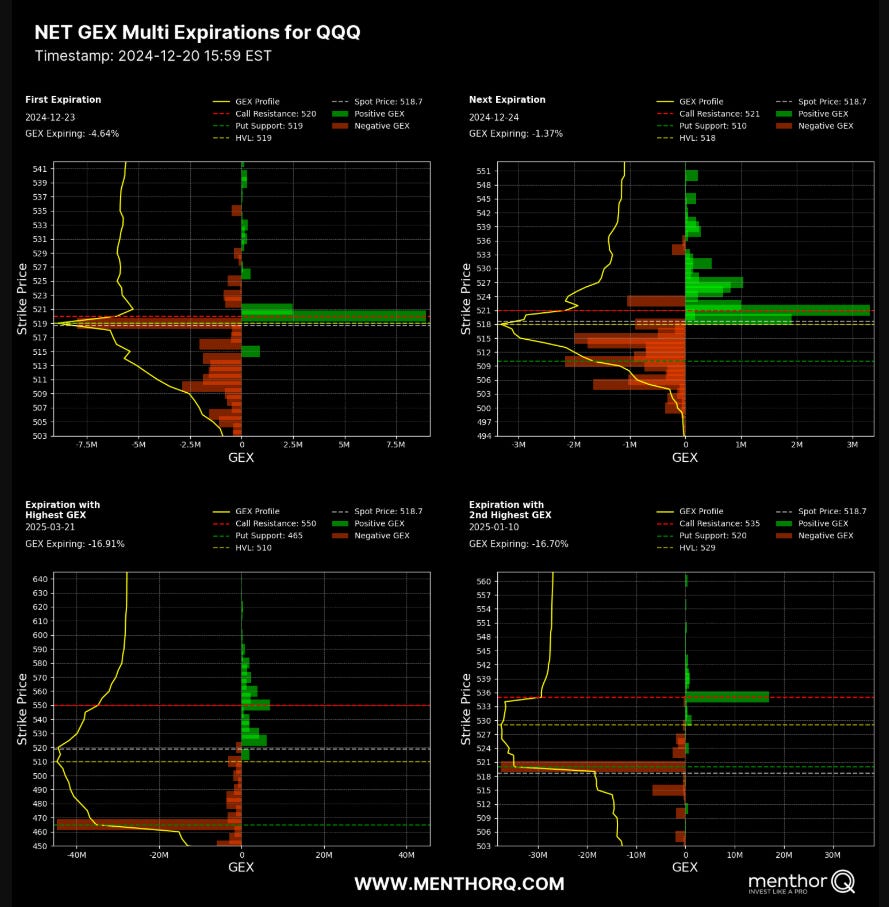

QQQ Gamma levels

The chart below shows the positioning information for QQQ. Price staying below 520 is viewed as bearish positioning. Above the 520 level is constructive to the bullish narrative. Additionally, the QQQs are below all short term moving averages ( 8SMA, 21 SMA), signifying a bearish to neutral narrative

The Weekly Plan and trading idea

Going into this week, I have neutral to bearish trades on the SPX ( the S&P 500 cash index). Therefore my current bias is neutral.

Current Bearish trade

For Demember 31 expiry I am net short calls with the following trade:

1 Long 6030 call, 2 Short 6050 call, 1 Long 6100 call.

This trade was put on for 2.50 credit per contract. It currently has probability of 80 percent to expire worthless.

The trade makes money below 6072.50 ( 6050 + 20 + 2.50) by the time of expiration. Currently SPX is trading at 5930. The maximum profit is obtained if the SPX expires at 6050, which would result 20 points per contract.

If I let the trades run till December 30, I will collect the full credit. I plan on closing these trades this week and potentially monetizing most of the credit received.

S&P futures Weekly Scenarios

Scenario 1

If price falls below 5900 then I would target 5850- 5800

Scenario 2

If price moves above 5980 then I would target 6030 to 6050.

I will look to take risk out of the trade (close them), once the profit hits 80 percent of the amount collected. If the trade goes against me, the trades will get closed at break even or small loss. The trade is profitable.

To compute the S&P 500 cash values, just subtract 60from the S&P 500 futures to get the equivalent prices.

Have a successful trading week, by waiting for your trade setups to come to you. Always manage your risk and understand what you expect to lose prior to trade entry. By managing risk, you unlock profitability.

Gamma Level data (netgex data) and skew data (market sentiment) was provided by menthorQ.com

Disclaimer

Please don’t follow my idea(s) blindly. Do your own due dilligence before you attempt to trade. Again, always manage your risk.

Thank you for reading my weekly plan.

Joel